The Compounding Earnings and Return on Capital of A Cypriot Company Vs Other Countries: A 20-year example simulation

Many people have heard that they can have great tax savings if they move their company to Cyprus, but what do these savings really mean for a company’s long-term growth and profitability?

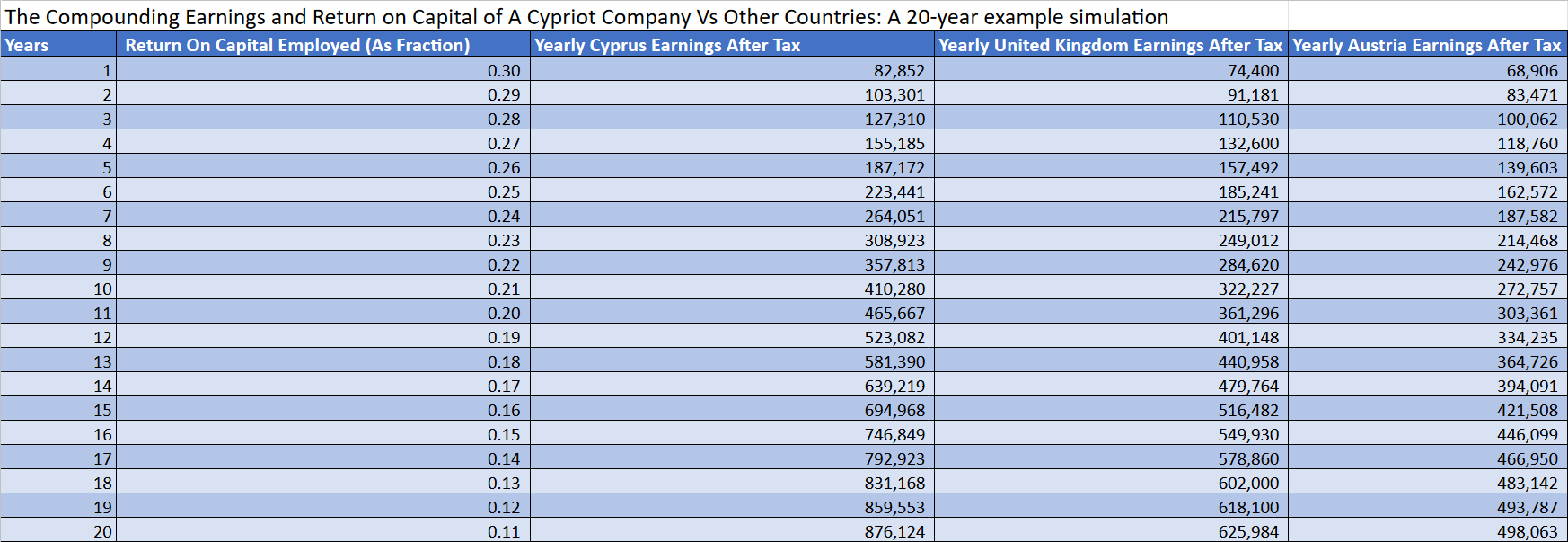

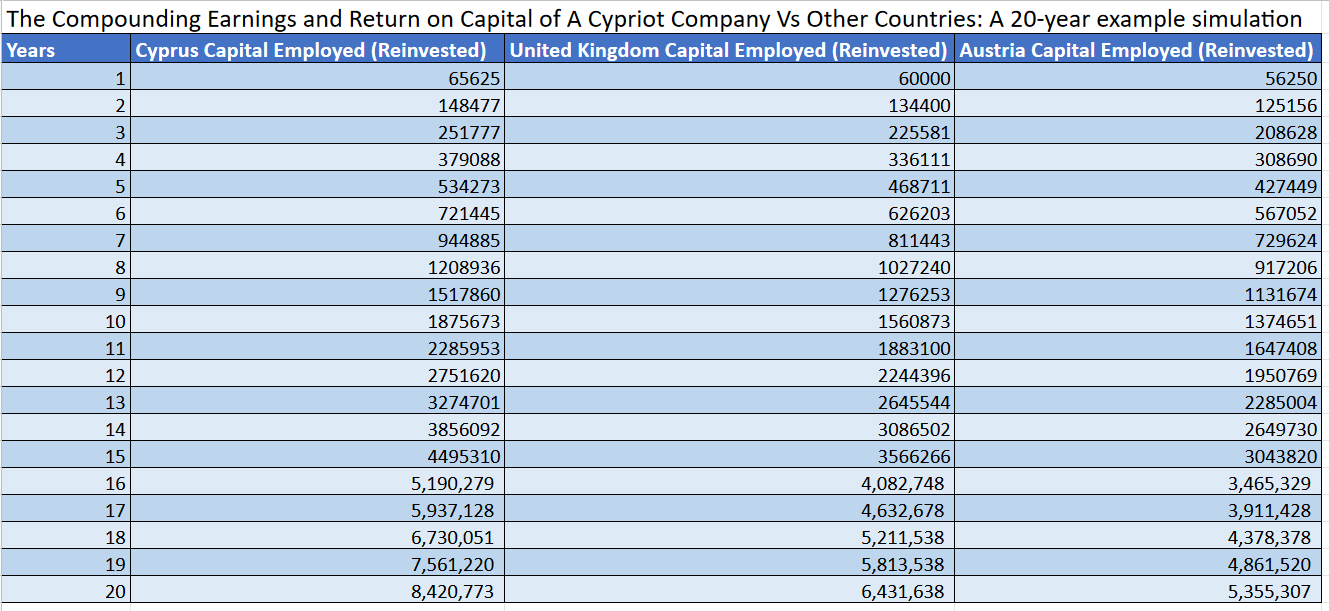

The Compounding Earnings and Return on Capital of A Cypriot Company Vs Other Countries: A 20-year example simulation

Many people have heard that they can have great tax savings if they move their company to Cyprus, but what do these savings really mean for a company’s long-term growth and profitability? That’s the question I wanted to get to the bottom of. In this article I will calculate, explain and show an example of a company under different tax regimes in Cyprus, Austria and the United Kingdom, and what effect this has on long term earnings and capital employed given some initial assumptions.

The readers are advised to remember that these are example calculations for entertainment purposes to highlight certain concepts and do not constitute financial advice. For financial advice on these topics please consult your accountants, lawyers, or relevant financial professionals. For more information regarding some of the benefits of Cyprus for business you can read here. Remember that Tax laws can change quickly and so you should ensure you speak to a professional to ensure you have the most up to date information to base your decisions on.

To begin, let’s start with a brief summary of what is being calculated. The calculations that follow are a simulation of a company going through 20 years of life under the three different countries’ tax regimes. At the end of the calculations, we can see how much the earnings are before tax, and the employed capital (in essence the assets available to the company) diverge for the three countries.

So what are the assumptions used in these calculations:

- The simulation lasts for 20 years

- The company before the start of the simulation earns 75,000 in profit and is taxed at the relevant corporate tax rate.

- All profits are channelled back into the company for growth. No dividends are paid for the simulation, but as Cyprus has 0% dividends Tax for Non-Domicile Tax residence, the benefit for Cyprus would be even greater for a specific sum of money paid out to shareholders pre-investment. To find out more about the non-domicile tax regime you can find out more here.

- The Return On Capital Employed (ROCE) starts at 30% and decreases linearly by 2% per year to simulate the increased difficulty of growth as the company becomes bigger.

- The Cyprus Corporate Tax Rate being 12.5% (2019)

- The United Kingdom Corporate Tax Rate being 19% (2019)

- The Austrian Corporate Tax Rate being 25% (2019)

- The year zero profits of 75,000 are present every year through the simulation in addition to other profits generated by ROCE.

- For simplicity of calculations and because what we are attempting to compare are tax differences, a currency exchange rate was set at 1:1. Thus negating this effect and giving a direct comparison. Thus number reported are in “units” and not a particular currency.

Now that we have the assumptions laid out, let’s take a look at how the calculations were done:

- Firstly, the pre-tax earnings had corporation tax applied so as to give post-tax profits

- This was then assumed to be re-invested in the company and so become the initial Capital Employed (CE)

- The Capital Employed was then multiplied by the current years Return on Capital Employed Rate in order to give the Earnings pre-tax due to the capital employed

- This Earnings pre-tax was then subject to the relevant countries corporate tax, leaving post-tax earnings.

- These post-tax earnings were then added to the initial post-tax earning assumption value for each country.

- This then became the new capital that could be invested for the following year and was added to the previous years Capital Employed (or assets held) giving a new Capital Employed total.

- This new Capital Employed was then multiplied by the next years Rate of Return on Capital, giving the next years pre-tax earnings.

- This was once again subject to the relevant countries corporate tax giving post tax profits and the cycle continues in this way for the full 20-year simulation

Now for some of you those steps may seem a little bit confusing, but to simplify it, the calculations show a company reinvesting all its profits after tax for 20 years and calculating the earnings produced. The conclusions are very dramatic as can be seen in the tables below:

Looking at the results, we see huge diversions of the “same company” operating in the three different tax regimes. The Cypriot company will have racked up roughly 8,500,000 in capital/assets, the UK company roughly 6,500,000 in capital/assets, and the Austrian in Comparison only roughly 5,500,000. That is roughly 3,000,000 in capital assets difference caused by the corporate Tax difference. Furthermore, in terms of yearly earning the company registered in Cyprus boasted post-tax earnings of 870,000, the UK company 625,000, and the Austrian 500,000. We can all see how these tax differences can affect growth and legacy of the company and owner.

Now of course these are static calculations with their initial assumptions, and there are more things at play for a company’s success than just finances. But the message is loud and clear, given a company, even relatively small tax differences can lead to extremely large differences in final results. Thus, if you are a European or international business owner looking to Cyprus to help fulfill your business and personal goals, Cyprus seems to be a great place for you.

If you would like to find out more specifics on Cyprus Corporate Tax and the various other business incentives that are currently available, please click the link. Also, if you would like to find out more about the great Personal Tax incentives available to entrepreneurs and businessmen including the Non-Domicile registration you can follow this link.

Written Febuary 2019

Find out more...

We’ve Got You Fully Covered!

By choosing us we guarantee you will enjoy all the great Tax & Lifestyle benefits of moving your business to Cyprus with ease

Office Space & Secretarial Services

Virtual offices, Corporate Space, and Secretarial Services to match your needs. We offer a wide range of solutions to meet your business and structural requirements

Get In ContactCompany Formations

From solo LTDs to Multinational Subsidiaries and Group Holdings, we can provide company formation structures tailored for you

Find Out MoreCorporate & Individual Tax Planning

Through our careful Tax plans and structures, we have what you need to help you keep and make the most of your money

Learn MoreAudit, Accounting, Payroll, VAT

We have everything you need to keep your company up-to date and running smoothly

Start Now