Saving For Retirement through Cyprus Non-Domicile Exception country comparison

Read here to find out how much of a difference the various tax set-ups for non-domiciles may help you plan for your retirement.

Saving For Retirement through Cyprus Non-Domicile Exception country comparison

Cyprus Non-domicile tax registration is becoming increasingly popular with entrepreneurs and businessmen throughout the world. Some of the benefits include 0% tax on dividends income, 0% tax on interest income, and 0% tax on rental income. These along with the various other advantageous business laws and happy island environment that Cyprus has to offer is causing the large financial immigration drive.

But how beneficial are these differences for a businessman that wants to save for their retirement? What difference would it make to a business owner or anyone investing in the stock market for their future? Those were the questions that were troubling me, so I decided to do some calculations to find out truly how much of a benefit there would be to my retirement through these tax set-ups.

Before we get started, the readers are advised to remember that these are example calculations for entertainment purposes only, in order to highlight certain concepts and do not constitute financial advice. For financial advice on these topics please consult your accountants, lawyers, or relevant financial professionals for retirement and tax planning. Tax laws constantly change so make sure you seek expert professional advice to ensure you are up to date before making any decisions.

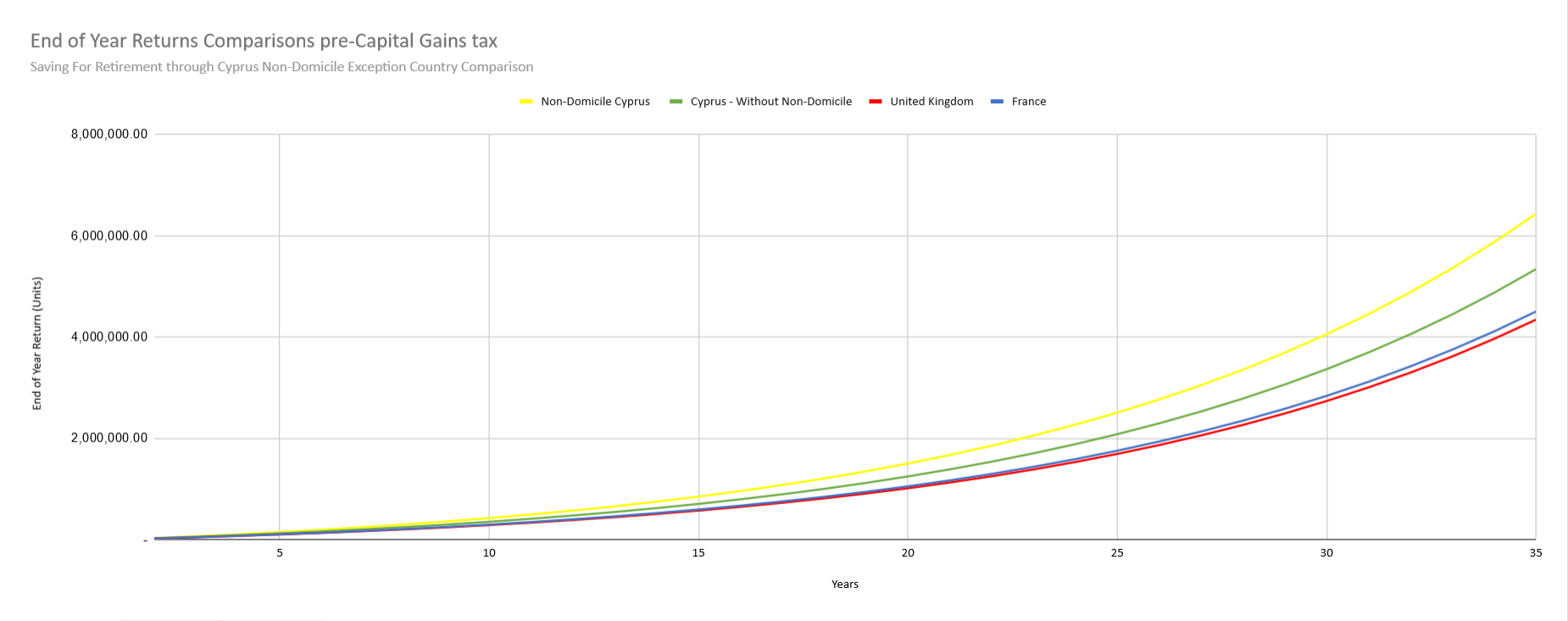

I decided to compare the end results of 35 years worth of saving for retirement in three different countries and four different tax regimes.

Before we get to the results what were the initial assumptions of the calculations:

- The business owner would put aside 30000 a year from corporate profits towards their pension withdrawn in the form of dividends.

- The individual would put this money in for 35 years.

- This money was then invested in the stock market through the purchase of equity and other corresponding index instruments.

- An annual return of common stocks in the long run was set at 9%, which is the rough historical average depending on which countries stock market you invest in.

- The Dividends tax rate for Non-Domicile registration was set at 0% in Cyprus (2019)

- The dividends tax rate for tax residence in Cyprus without Non-Domicile registration was 17% (2019)

- The dividends tax rate for the United Kingdom was 32.5% (High bracket income individual) (2019)

- The dividends tax rate for France was set at 30%, including mandatory social insurance contributions (2019)

- The capital gains tax on stocks was set at 0% for those in Cyprus (2019)

- The capital gains tax on stocks was set at 20% for those in the United Kingdom (2019)

- The capital gains tax on stocks was set at 30% with the new tax regime in France (2019)#

- The owner would continue to re-invest their money and would not dispose of assets until retirement and as such only be subject to capital gains tax at the end of the 35 years.

- For simplicity of calculations and because what we are attempting to compare are tax differences, a currency exchange rate was set at 1:1. Thus negating this effect and giving a direct comparison. Thus number reported are in “units” and not a particular currency.

So now that you know some of the basic assumptions for the calculations, how were the calculations done for each country:

- Every year 30000 was subjected to the corresponding dividends tax.

- The remaining amount was then assumed to be invested through the stock market.

- An annual return of 9% was then added to that initial amount.

- The following year another 30000 was subject to the corresponding dividends tax, and the remaining amount then added with the previous year’s investments.

- This new total was then subject to a 9% annual return.

- This Cycle was repeated for 35 simulated years.

- Following the 35 simulated years, the corresponding Capital Gains tax was applied, leaving the final retirement fund available for the investor.

So what did the results show? Before capital gains were applied, in the leading position, those who invested while having a Non-domicile tax residency in Cyprus were able to save 7,053,741 for retirement. Those in Cyprus but without obtaining the Non-domicile status saved 5,854,605 for retirement. In last place were those in the United Kingdom who managed to save 4,761,275. In third place were those in France who saved 4,937,619.

Even before Capital Gains Tax is applied more than 2,000,000 (Two Million) gap can be seen for those who were Cyprus Non-domicile tax residences as compared with the United Kingdom and France.

This Gap become even larger when the Capital Gains tax is applied. Now of course more complex constructions for retirement planning can be created to reduce some part of the Tax burden in the United Kingdom and France, but with Cyprus bosting 0% tax on Capital gains through the sale of stock/securities, Cyprus consistently comes out at the top of the table for saving for retirement.

When the corresponding Capital Gains Taxes are applied, those with Non-Domicile status in Cyprus, and those in Cyprus without Non-Domicile status get to keep their original investment value of 7,053,741 and 5,854,605 correspondingly. The United Kingdom however drops to 3,950,770 and those in France even further down 3,676,833. This creates a roughly 3,500,000 million difference in the retirement money someone can have for themselves and to pass down to their families if they had obtained a Cyprus Non-Domicile registration, as opposed to not.

In conclusion, a huge difference is seen between Non-Domicile tax registration in Cyprus and other nations even before the Capital Gains Taxes and other Wealth Taxes are applied. When these are applied an even greater difference between Cyprus and the other countries in terms of final wealth is created. As these calculations show, those of you who are conscious of your future retirement state and the wealth that you are able to leave to your family, Cyprus may be a great option for you.To learn more about all the amazing business and tax benefits, you can see our Company, Individual & Family, and Immigration Benefits.

Written Febuary 2019

Find out more...

We’ve Got You Fully Covered!

By choosing us we guarantee you will enjoy all the great Tax & Lifestyle benefits of moving your business to Cyprus with ease

Office Space & Secretarial Services

Virtual offices, Corporate Space, and Secretarial Services to match your needs. We offer a wide range of solutions to meet your business and structural requirements

Get In ContactCompany Formations

From solo LTDs to Multinational Subsidiaries and Group Holdings, we can provide company formation structures tailored for you

Find Out MoreCorporate & Individual Tax Planning

Through our careful Tax plans and structures, we have what you need to help you keep and make the most of your money

Learn MoreAudit, Accounting, Payroll, VAT

We have everything you need to keep your company up-to date and running smoothly

Start Now